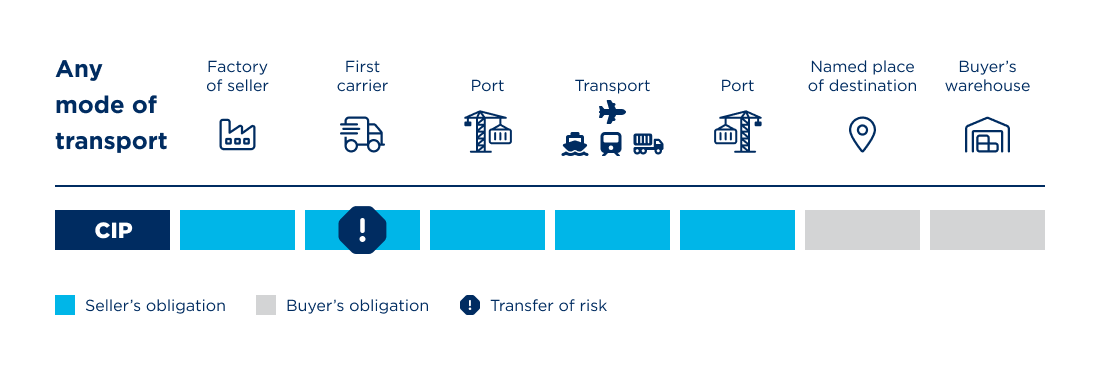

With CIP ("Carriage and Insurance Paid to [named place of destination]"), the seller takes care of transporting the goods to a destination requested by the buyer. If the goods are transported beyond the country's borders, the seller is also responsible for all export formalities - from goods inspections to customs clearance. The risk for the transport is already transferred to the buyer after handover to the first carrier. In contrast to the otherwise identical Incoterm CPT (Carriage Paid To), however, the seller must take out insurance for the goods in transit at the seller’s own expense. The CIP Incoterm can be used for all types of transport.

CIP Risk Transfer

As with all two-point clauses of the C-group, the transfer of risk and cost are at different points in the CIP Incoterm. The risk for the consignment is transferred to the buyer as soon as it is handed over to the first carrier, but the costs for the transport continue to be borne by the seller (until the destination). Only there does the buyer's responsibility for the final transport begin - typically starting with import processing and customs clearance. However, the buyer is also responsible for any transit via third countries. The buyer bears the costs and takes care of all formalities (regulated under CPT B7). As with other Incoterms, it is advisable to define the place of delivery and destination as clearly as possible. This avoids grey areas which can lead to disputes in the event of damage or loss.

CIP Insurance Coverage

CIP is one of the clauses that have been adapted within the scope of Incoterms 2020. The change refers exclusively to the required CIP insurance coverage. Previously, a minimum insurance cover was sufficient (clause C of the "Institute Cargo Clauses" or comparable ones such as the DTV Freight Insurance Conditions). Incoterms 2020 now require comprehensive insurance cover of clause type A (all risks). For the comparable Incoterm CIF (Cost, Insurance and Freight), which is intended exclusively for sea freight, insurance cover of clause type C remains sufficient.

CIP Insurance coverage and obligation to provide evidence

The sum insured must be equal to 110% of the price of the goods specified in the contract, payable in the currency used in the contract. The seller is obliged vis-à-vis the buyer to prove that the insurance has been taken out.

Attention: Sometimes it can happen that the country of destination requires that the insurance cover is taken out within the country or that non-licensed (non-admitted) insurers are prohibited. This can cause problems for the seller. In this case, one should use the Incoterm CPT in case of doubt, and the buyer takes over the conclusion of the insurance.

Continuous insurance cover for transport

It makes sense to take out insurance for all sections of the transport route - in other words: for seller and buyer alike. The CIP Incoterm mainly deals with the part of the route from handover to the first carrier, but the seller naturally has an interest in transport insurance up to this point of handover. In principle, of course, each contracting party can separately insure their own part of the route for which they bear the risk, according to the Incoterm CIP. However, damage can occur at the transfer of risk, and - at least from the point of view of the respective insurance companies - the responsibility cannot be clearly allocated. These potential disputes can be avoided by taking out a comprehensive insurance policy. Buyer and seller can agree on the respective share of the insurance costs.

Reading tip: Incoterms CIP and CPT are identical except for the topic of insurance. This section therefore focuses on the topic of insurance cover - other aspects of the Incoterm rules that apply to CIP are dealt with in more detail in our info text on Incoterm CPT.

The seller shall take care of the transport to the agreed destination and shall bear the costs for this, including packaging of the goods and unloading at the destination. In the case of export to foreign countries, the seller is also responsible for the handling and costs of customs clearance. If the transport goes via third countries, the buyer must bear the costs and handling of customs formalities. For the transport (at least) to the place of destination, the seller must take out transport insurance at their own expense, which covers all risks for the goods.

The buyer pays the import of the goods (customs and costs incurred upon receipt of the goods). Furthermore, the buyer bears the transport costs in the country of destination.

The "Institute Cargo Classes" (ICC) serve as orientation for the conditions of the transport insurance. While clause type C was still assumed as standard in the Incoterms 2010, which applies unless otherwise agreed, the significantly more comprehensive clause type A is now required as minimum cover. Clause type C only covers certain explicitly named loss events such as stranding or capsizing, seaquake, fire or general average. Theft and goods being washed overboard during transport, for example, are not included.

The clause type ICC A, on the other hand, covers a wide range of risks. Nevertheless, the designation "all risks" can be misleading, because protection against the consequences of war, strikes or wilful damage is not necessarily included. If the buyer wishes these risks to be covered as well, this is done at their own expense. The sum insured must cover 110% of the contractually agreed purchase price.