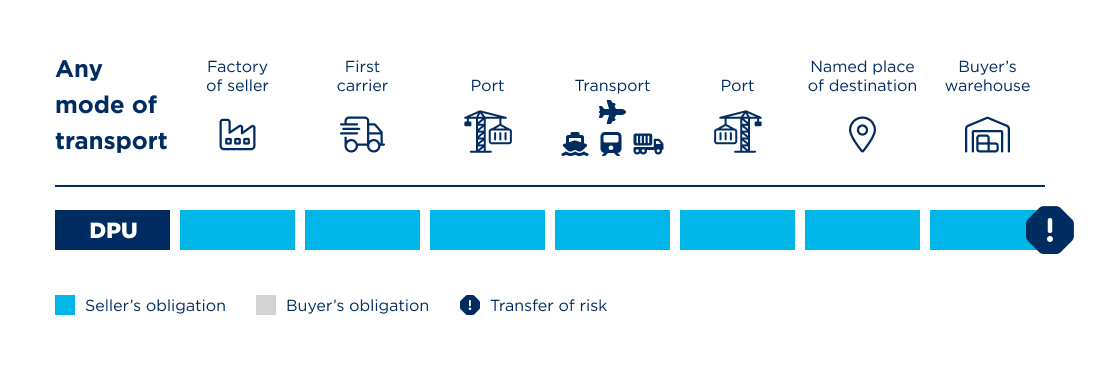

The Incoterm DPU, like DAP and DDP, belongs to the group of "arrival clauses" where the seller assumes all the risks and costs of transporting the goods to their destination. For DPU, the seller's obligations also include - as required - expenses and formalities regarding export and transit via transit countries. In contrast to DAP ("delivered named place") and DDP ("delivered duty paid"), the seller is also responsible for unloading and bears all the associated costs and risks. DPU replaces the Incoterm clause DAT ("delivered terminal"), as other places besides a terminal can be specified as the place of delivery. After unloading and making available by the seller, delivery shall be deemed to have taken place and the risk shall pass to the buyer. DPU is identical to Incoterm DAP except for the seller's obligation to unload.

DPU Incoterms 2020: Exact determination of the place of delivery / transfer of risk

The moment of transfer of risk is always critical. If there is a grey area around the exact moment of the transfer of risk due to unclear specifications and the goods are damaged or lost, disputes are inevitable. If you want to avoid the risk of disputes when using the DAP Incoterm, the place of destination or delivery should be defined as precisely as possible, because this also specifies the moment of transfer of risk. The question of who bears the costs up to which point in time can also be determined precisely.

Delivered at Place Unloaded: Unloading at destination

With the Incoterm DPU, the cargo is unloaded at a point where the buyer can receive it unhindered to unload or reload it. This can be, for example, unobstructed access to a container used for transport. The act of delivery is completed when the goods are "made available" (important regarding agreed delivery periods/dates!). The seller must also hand over to the buyer the documents entitling them to take delivery of the goods. It is also important that the seller informs the buyer in good time about the upcoming delivery in order to be able to make the necessary preparations.

DPU Incoterm: Transport insurance

As with all other Incoterms - except CIF and CIP - there is no obligation for the seller or buyer to take out insurance. However, if the risk is borne for a certain part of the transport, it is usually advisable to take out insurance as well. In the case of DPU, it is advisable for the seller to insure transport including unloading accordingly, as they bear the risk up to the destination (however, an external carrier has a certain, limited liability protection). If the seller needs information or documents from the buyer in order to take out insurance, the latter must provide these, and the seller must bear the costs.

With the Incoterm DPU, the seller pays the costs of packaging and transport to the agreed destination. In addition, they are responsible for the costs and formalities regarding export and transit, if these are necessary. Unloading is also still the responsibility of the seller - this is the specific feature of the Incoterm DPU.

The seller bears the risk until delivery and unloading at the place of destination. As soon as the goods have been unloaded at the agreed place and the buyer has unhindered access to them, the seller has done their duty and the goods are deemed to have been delivered. At that moment, the risk is also transferred to the buyer.

From the buyer's point of view, the Incoterm DPU offers advantages, as transport and even unloading are carried out by the seller at the place of delivery. The seller bears the costs and risk up to that point, and export and transit via transit countries are also carried out by the seller, including the costs incurred.

When it comes to deciding who to entrust with the unloading - the seller as with DPU or the buyer with Incoterm DAP - it should depend on the possibilities and circumstances. Does the buyer or the seller have better conditions for efficient unloading? An additional obstacle when using DPU Incoterms 2020 may be that the importing country requires that import clearance and import customs clearance be carried out before unloading - but this is the responsibility of the buyer! In this case, the choice of Incoterm DAP over DPU ensures a clearer transfer of responsibilities. Incoterm DDP can also be used where the import is the responsibility of the seller but - as with DAP - the goods do not have to be unloaded.