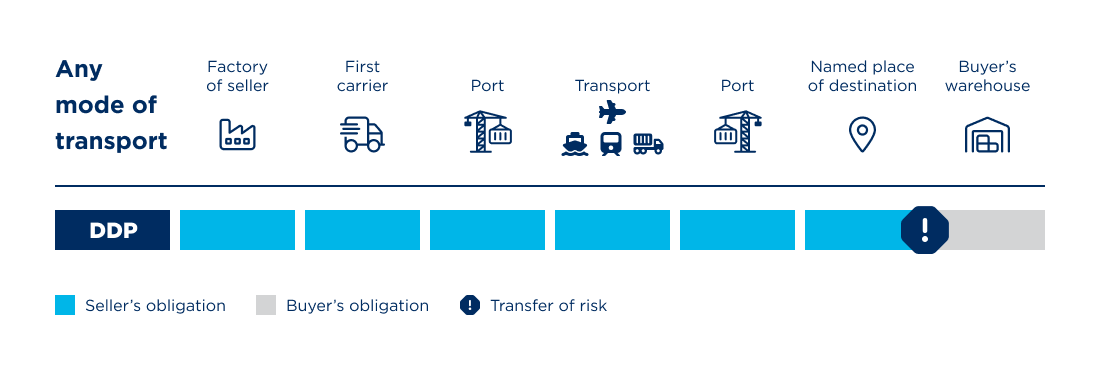

The DDP Incoterm assigns most of the obligations to the seller, and consequently the demands on the buyer are reduced. With the shipping term DDP, the seller not only takes care of transport, export and transit (including costs and risks), but also of the import of the goods in the destination country, i.e. all customs formalities, including the associated costs. The seller must make the goods available on the arriving means of transport, cleared for import and ready for unloading. Since importing to a third country (i.e. not a country in the European Economic Area (EEA)) can present challenges for the seller, this Incoterm should be chosen with care. The possible problems for the seller range from incurring import sales taxes in the destination country that cannot be recovered, to delays in customs clearance that jeopardise timely delivery. Import clearance may even be completely impossible because the importing country requires a person established within the customs territory to declare the import.

DDP delivery, unloading and transfer of risk

As with all D-group Incoterms (also known as ‘arrival clauses’), the delivery and destination are identical. This also means that the transfer of risk and costs occurs at the same time. The place of delivery should be specified as precisely as possible. As soon as the goods have been made available at the agreed destination, ready for unloading, on schedule and in good time after customs clearance, and the necessary delivery and transport documents have been provided, the seller has fulfilled their delivery obligation. It is also important that the seller informs the buyer in good time that the goods have arrived.

The buyer, in turn, is obliged to accept the goods ‘physically’. Note: This acceptance does not yet constitute approval of the goods as being in accordance with the contract. If the goods are damaged or lost, the buyer must still pay for the freight (exception: subsequent damage, etc. can be attributed to the seller's misconduct).

The buyer must provide the seller with information and documents upon request for all formalities related to export, transit and import processing.

What does ‘ready for unloading’ mean?

As already mentioned, the seller is – unless otherwise (additionally) agreed – not responsible for unloading. They merely ensure that the buyer can accept the goods without hindrance, for example by opening the means of transport and unsecuring the load. If the goods are in a container, freely accessible means that the container containing them is not obscured by other containers. For generic goods, the load intended for the buyer must be labelled.

DDP: Transferring unloading to the seller

If the buyer wants the seller to unload the goods, they can alternatively choose the Incoterm DPU. However, in this case, the seller is no longer responsible for the import. If the seller is to remain responsible for the import, it can be additionally specified in the contract of carriage that the seller is to unload the goods within the scope of the shipping term DDP. Finally, each Incoterm can be adapted or supplemented as appropriate.

DDP import customs clearance

The seller may face various hurdles when importing, especially from the EU to a third country. First of all, customs duties can be high, and the seller must take this into account when setting prices. Furthermore, the duration of customs clearance poses a risk, since timely delivery is a central requirement for the seller with DDP. In the event of a delay, the buyer may be entitled to withdraw from the purchase or even claim compensation. Finally, the seller must be able to estimate in advance how long the formalities will take and include this in the delivery time. Delays may also necessitate the payment of storage fees.

Larger forwarding agents can take over DDP customs clearance and manage timings. The freight forwarder's branches in the destination country enable experienced local specialists who are familiar with the local regulations and customs requirements to ensure a smooth import process.

DDP import VAT sales tax: can the seller/exporter get it back?

Another critical factor with DDP is the import sales tax that is incurred (these taxes are not customs duties but are incurred in addition). The so-called import sales tax within the EU prevents goods from abroad – which were not subject to taxation as export goods – from being a lower price and thus having a competitive advantage over taxed goods from the domestic market. That is why import sales tax is levied on goods imported from third countries. The percentage rate levied here is usually the same as the sales tax of the importing country. In third countries, there are comparable tax rates, for example under the designation VAT alias ‘Value Added Tax’.

The problem is that VAT is designated as a ‘transitory item’ that can be reclaimed from the state. However, this is only possible if you are registered in a third country. Even the import clearance itself can be refused if it is not carried out by a person established in the customs territory (as is the case within the EU).

Using Incoterm DDP with the addition ‘excluding import sales tax’?

If the buyer's main concern is to transfer the processing of the import to the seller, but not necessarily to impose the sales taxes due, the DDP clause can be agreed with a corresponding addition that the buyer will bear the import sales tax. As a seller, the compelling argument in favour of this is that you would otherwise have to add this tax to the selling price. If the buyer is entitled to input tax deduction, they will get better conditions with the Incoterm ‘DDP excluding VAT’. However, it is not easy to implement in practice, as each country has different regulations regarding who is even allowed to pay the import sales tax. After all, Incoterms are not laws and therefore cannot override applicable law. Even local fiscal representatives, who, as indirect representatives, make a customs declaration on behalf of the buyer, are not a solution without grey areas and possible pitfalls.

No! Both are to be considered and paid for separately. With Incoterm DDP, it is often overlooked that in addition to customs duties (for example, when importing from a third country into the EU), import sales tax is also incurred, which prevents untaxed goods from being imported into the EU (or other corresponding economic areas).

With DDP, the goods are considered to have been delivered as soon as they have passed through all import formalities, including the payment of customs duties and import sales tax. Furthermore, the goods must be made available, ready for unloading, along with all documents that entitle the buyer to take delivery.

The requirement to comply with deadlines for delivery refers to the time after completion of the import process, including customs clearance and other formalities such as security clearances, goods inspections, etc.

None of the contractual partners is obliged to take out transport insurance. It makes sense for the seller in particular, since they organise the main transport and bear the risk here. If the seller wishes to take out insurance, the buyer must provide them with all the necessary documents and information on request (at the seller's expense).

For many reasons – as already mentioned – the Incoterm DDP can lead to problems. There are many difficulties, grey areas and workarounds when it comes to DDP customs clearance and the payment of import sales taxes, which can lead to problems. As a seller, you should not offer a DDP delivery ‘voluntarily’, but rather a DAP delivery, for example. If the buyer requests delivery according to DDP, the seller should check carefully whether they are able to do so, especially with regard to importing the goods into a foreign destination country and the legislation there. Since the recipient is usually entitled to deduct input tax in their own country, importing the goods presents fewer problems for them. The additional costs can be regulated via the selling price.