Dear Valued Customer,

Welcome to the Röhlig Australia Market Update -October 2022. We will continue to be in contact with you, letting you know what is happening in the world of freight forwarding and logistics. If you have any questions and would like to address them, please send them to rohlig.australia@rohlig.com. We appreciate your suggestions and feedback.

Please click the links to find out more

Oceania (still) in a holding pattern

Flight numbers are still holding steady at around 50-60% pre-covid levels.

Globally, airlines are reluctant to add flights to lanes until flights are over maximum capacity, with flight cancellations and re-bookings common. For now, this is keeping airfreight and airfare costs high.

Expect to pay high prices’: Aussies to fork out more than double on airfares this Christmas

Locally, we are seeing additional seats added by using larger aircraft, with many more A380’s returning to service. Unfortunately, these aircraft are not the best for cargo, as their bellies run full of baggage from the huge passenger numbers on board.

While the change in routings and aircraft are constant at the moment, we are not seeing great changes in capacity yet. The additional capacity will be soaked up by the peak season for air cargo, with relief in capacity and costs likely in Q1, 2023. The final curveball is oil and aviation fuel costs.

Oil and Jet fuel prices

Oil futures are sitting at a pretty hand of 85 USD per barrel at the time of writing.

The mild decoupling of jet fuel prices to oil that started in 2022 is evident in the below graph, where when we see a swing in oil prices, we get a much larger swing in jet fuel prices, causing rates and fuel surcharges to continue to bounce heavily.

This is a result of inflation in fuel production costs, for which at present has no end in sight, meaning high fuel variability compared to the past is here to stay for a while.

(See the chart here: https://www.tradingview.com/chart/?symbol=TVC%3AUSOIL or download PDF version below)

Australia

Passenger flights stable since our last newsletter, with no additional freighter capacity. Freighters and passenger flights continue to be at capacity, we expect now this to be the case through the end of the year.

New Zealand

Qantas is cutting down on seat numbers Trans -Tasman, moving many flights back to the narrow body as they send their wide bodies on other routes with better yield. This will leave the Trans-Tasman capacity absolutely full to the brim and then some until January; expect very real constraints to come in from November.

We know additional capacity from other parts of the world will sometimes enter in Q1 or Q2. However, in the meantime, NZ is at the end of the A380 problem, and we expect Auckland and Christchurch to be last to see any noticeable cost ease.

Asia

Asia rates continue to be highly volatile. Yield management with Asian carriers heavily affects rates as they balance demand from cargo transhipping from other parts of the world to Australia, keeping the rate market incredibly dynamic.

The little low season in China, with large, heavy shipments benefiting the most, contact us for any shipments you have, and we will look at the best options for you at the time.

USA

US space remains per the status quo, with limited options, however, we are managing well with mid-west and east coast shipments. The west coast can still be choppy, with passenger flights running across the long pacific route not always managing to take belly loads.

Airline and terminals’ staff shortages are ongoing and not dissimilar in Australia. In addition, ground handling continues to be a challenge US wide, pushing up airline operating costs which are not helping passenger or freight costs.

We are seeing plausible options now ex JFK, contact us for more information.

Europe

Europe continues to be steady, with flights and costs full, however, this year’s peak season appears to be lower than last year’s, as we now see the effects from rising inflation and energy costs take the edge of the peak tonnages.

The A380 effect is strong ex Europe, so we are trying to find a new and creative way to move cargo while 777 numbers are dropping off, until such time as passenger demand adds more flights then there are A380s that can service ANZ.

For more information about our Air Freight services, please click Rohlig Air Freight.

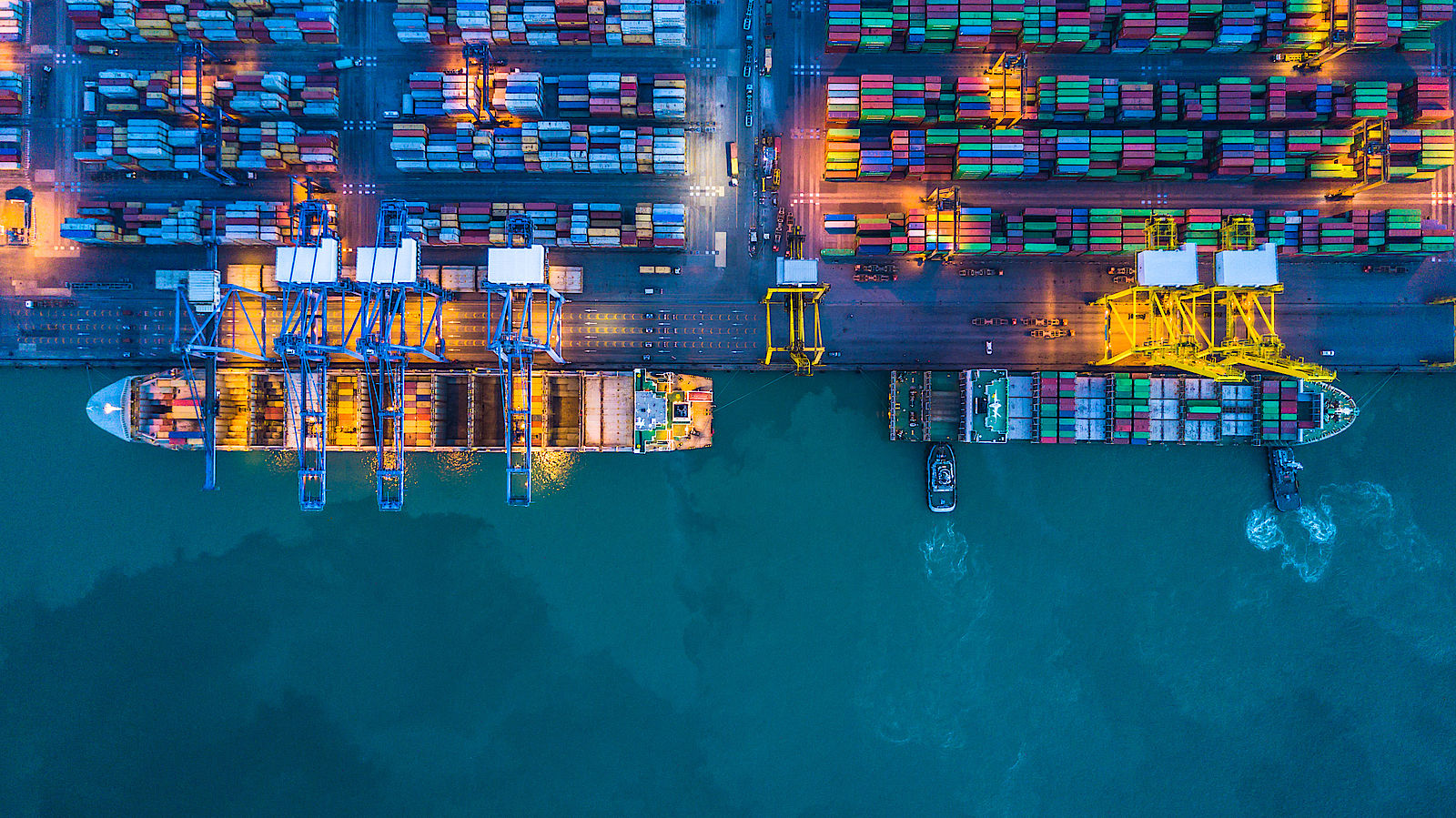

Global schedule reliability is starting to improve compared with 2021 which saw record lows for schedule reliability.

Please checkk the graphs in PDF file that illustrate how challenging 2021 & 2022 were compared to 2018, 2019 & 2020. All indications are that improvements will continue, schedule reliability will increase and late vessel arrival days continue a downtrend.

Besides better schedule reliability this should also add vessel capacity back into the markets

Oceania

FOCUS Container to launch Trans-Tasman

FOCUS Container Line is to next month launch its new Trans-Tasman schedule which initially includes a China connection said to be required to position containers for the service. According to a FOCUS-branded schedule this week sighted by the Shipping Gazette™, the service is to be plied by the 161-metre and 18,567-GT BBC Denmark and the 172-metre and 17,961-GT G. Box.

Vessel tracking sites list the former as a general cargo vessel and the latter as a containership, with the vessels having three and two onboard cranes respectively. The schedule commences with the BBC Denmark departing Ningbo in China on Thursday next week, with the vessel due to call at Auckland on November 12 and Brisbane on November 20, before returning to Ningbo on December 4.

The G. Box is due to operate to a similar rotation and timings between ports over the second and fourth scheduled voyages – although alternating Melbourne and Brisbane with those sailings involving calls to Auckland on December 1 and then January 13.

However, in-between, the BBC Denmark is scheduled to make voyage three on what may mark its commencement of dedicated Trans-Tasman service. After departing Ningbo on December 9, its subsequent arrivals rotation entails:

• Auckland – December 24 • Brisbane – January 1 • Melbourne – January 6 • Auckland – January 13 • Brisbane – January 21. Please contact us for more information regarding this service.

(Source: The New Zealand Shipping Gazette September 10, 2022)

Asia

New lockdowns in key Chinese transport hubs hobble supply chains again

Lockdowns in key Chinese port cities are again hampering supply chains, despite a “muted” peak season. And President Xi gave no indication of a change to China’s zero-Covid policy at the Communist Party Congress, where he obtained a record third five-year term in office. Indeed, in what has now become a regular occurrence, Covid restrictions are impacting supply chains in Ningbo, Shanghai, and Tianjin. Ningbo is the worst affected, with forwarders reporting disruption to the area around the port going into lockdown. (For more information read here).

Ocean carrier voyage blankings causing chaos and confusion for shippers

Ocean carriers are ramping-up their vessel blanking programmes from Asia as export demand weakens, but last-minute cancellations are causing chaos in supply chains and confusion within liner offices. Moreover, shippers are having to navigate their way around ‘officially’ announced blank sailings and voyages pulled just days before arrival in China and held off the loading port, in what carriers term as ‘slidings’. ( Click for more details)

Europe

Euro ports brace for more throughput declines as carriers blank more sailings

The top North European container hub ports are seeing a considerable reduction in alliance calls from Asia, and so are bracing for a significant drop in throughput in the final quarter. Ocean carriers are being forced to drastically adjust weekly capacity from Asia to Europe and the US against a background of exceptionally weak demand – and the bleak outlook could see many more advertised sailings withdrawn in the coming months. (Read more here)

Ports face more strike action as the cost of living bites

The fast-rising cost of living crisis in Europe and the UK is likely to precipitate more labour disputes across developed markets as dock workers seek to make up for rampaging price inflation, heaping more disruption on congested ports, says UK maritime consultancy Drewry. Strike action at major German and UK ports has caused major disruption to carrier schedules and has adversely impacted port performance with average call durations rising after the strike action.

A series of dockworker strikes impacted the main German seaports in June and July, while the UK’s largest container port Felixstowe was hit by two 8-day walkouts in late August and September. In response to these planned strike actions, carriers took steps to divert vessels away from the impacted terminals. However, Drewry’s analysis, published in its Ports and Terminals Insight, shows a significant increase in pre-berth waiting time, especially in Hamburg, where larger mainline vessels incurred an average 4-day wait to enter the port in July and August.

While agreement with the unions has now been reached in Germany, labour availability – particularly at weekends – remains challenging. As a result, disruption is expected to continue through Q4, 2022.

(Source: The New Zealand Shipping Gazette October 22, 2022)

USA

Import gateway shift pushes Houston to the top of port congestion league

To avoid the congestion at major west coast gateways, US importers have now clogged up ports elsewhere and, instead of Los Angeles and Long Beach, it’s Houston that now has the biggest problem, according to ITS Logistics. It’s current US Port/Rail Ramp Freight Index rates operational issues at the US Gulf region’s port as ‘high’, whereas operations on the west coast are normal. Other regions are rated as having ‘moderate’ issues.

Houston’s challenges span the gamut of problems importers and operators have been struggling with for the past year – from vessel congestion and clogged terminals to depleted chassis pools and low container storage space. All these issues, plus the Gulf hurricane season, are regarded by ITS as potential headwinds for Houston. (More information here)

Extension of the additional customs duty on Russian and Belarusian goods

The Australian Border Force has published Australian Customs Notice 2022/45 (CLICK HERE) to confirm that the Australian Government has extended the additional duty on goods that are the produce or manufacture of Russia or Belarus for twelve months.

These goods will continue to have a rate of customs duty of 35% or greater and will only be eligible for concessional treatment under certain concessional items.

The original measure applied the additional duty to these goods where they left for shipment to Australia on or after 25 April 2022.

It applied for a period of six months and was due to end on 24 October 2022.

The measure has been extended for a period of twelve months to 24 October 2023. If you have any questions please do not hesitate to contact your local Rohlig representative or our friendly customer service team.

Thank you for your ongoing support of Röhlig Australia and New Zealand. We will continue to keep you updated, however should you have any questions relating please do not hesitate to contact your Röhlig Account Manager or Customer Service Representative.

DISCLAIMER - All information is provided in good faith for guidance and reference purposes only. It is of a general informational nature, and Röhlig Logistics GmbH & Co. KG takes no legal responsibility for the accuracy of the information provided via this document. Röhlig Logistics GmbH & Co. KG makes no representation as to the accuracy or completeness of any of the information contained herein and accepts no liability for any loss arising from the use of the information provided.